Simplifying

Goods and Services Tax

By

Dr. Lalit Kumar Setia

The economic progress of India is

entirely dependent upon Goods and Services Tax as it has replaced many taxes

and being charge as single tax on goods and services. The 'Leaves of Progress'

website is providing the simplification of its concept so that readers be

benefited with easiest way to understand the Goods and Services Tax

(GST).

Why Constitution is amended to impose GST Act?

Earlier

the state government had no power to levy tax on services and the GST

imposition required the state government to impose tax on services. In 2016,

the constitution is amended to empower both central and state governments to

levy tax on supply of both goods and services.

GST Network Company to ensure IT infrastructure:

In order to ensure good IT

infrastructure, Goods and Services Goods and Services Tax Network (GSTN), a

non-Government private limited company was incorporated in 2013 in which

Government of India held 24.5% equity and 24.5% by States, balance 51% equity

of Non-Government Financial Institutions. The GSTN with support of Infosys

providing one stop filing of all taxes to tax payers, and ensuring the IT

infrastructure and services to Governments, tax payers, and other stakeholders.

The GST portal also has provision for helpdesk support. The cost of GSTN project

is Rs. 1,380 Crores and the project not covered ‘audit and enforcement’

functions of tax department. The GSTN has also developed mobile apps for

generating invoices and processing of GST returns.

The

laws related to GST are passed in Parliament (for CGST and IGST) and State

Assemblies (for SGST) as per the provisions of constitution. The GST Council is

empowered to decide the rate of GST on various types of goods and services.

Before the enforcement of GST, the taxability was at the time of manufacturing

/ production (as Excise Duty), sale (as Value Added Tax), import or export (as

Custom Duty), Rendering Service (as Service Tax) and after enforcement of GST,

the taxability is on ‘Supply including Import or Export and Rendering of Service’.

Under GST, the point of payment for taxes is only at the ‘Time of Supply of

Goods or Clearance from Custom’.

Imposition of Goods

and Services Tax (GST):

It is well known that the government

earns most of its revenues from taxes and Goods and Services Tax (GST) is an

indirect tax introduced with replacing many previously existed taxes. It was

introduced from 1st July, 2017 as a multi-stage,

destination-based tax. The Government of India with the enactment of GST Act,

empowered both Centre and States to levy the taxes on both goods and services

keeping in view ‘One Nation – One Tax’. Here tax is levied on ‘supply by one taxable

party to another taxable party’ and the credit of paid GST flow only in case of

B to B transfer. The earlier use of Form C, F, E-1/ E-II, Waybills etc. are

also transformed with the new provisions of GST.

The manufacturers buy raw material

with paying Goods and Service Tax on the cost of raw material, after

manufacturing, they sell finished goods by charging Goods and Service

Tax to the whole-sellers and the whole-sellers sell the goods to retailers

by charging Goods and Service Tax from retailers and finally, the

retailers sell the goods to consumers by charging Goods and Service

Tax from consumers. In this way, the Goods and Service Tax is

imposed at every point of distribution channel.

What does

Destination-based tax mean?

The Goods and Service

Tax is a destination based tax which means it doesn’t matter where the raw

material is sold or goods are manufactured; the entire Goods and Service

Tax will go to the State where the finally goods are sold to the final

consumer. For example, sugarcane is imported from Uttar-Pradesh and Sugar is

manufactured in Delhi and then consumed in Rajasthan; then the Goods and

Service Tax revenue for the sale of sugar will go to the basket of

Rajasthan Government.

The main objective for imposing GST

in place of other indirect taxes, is to reduce the cost of compliance of

indirect taxes by imposing single tax from the manufacturer to the consumer

depending upon the nature of goods and services under consideration. With

imposing GST with the help of its filing system through software and use of

information technology, the maintenance of multiple records at multiple levels

is controlled. It has also reduced and eliminated double taxation particularly

in case of work contracts.

What items are excluded from GST?

The GST Council is empowered to

finalize the GST rates, exempted goods and services, the threshold limit for

turnover exempted from GST etc. The chairperson of the GST council is ‘Union

Finance Minister’ and members include State Finance Ministers of all States.

GST has been imposed on all goods and services except Alcoholic Liquor,

Electricity, and Petroleum Products (Crude Oil, Diesel, Petroleum, Natural Gas,

and ATF). The goods which covered under GST, are the goods of ‘every kind of

movable property other than money and securities but includes actionable claim,

growing crops, grass and things attached to or forming part of the land which

are agreed to be severed before supply or under a contract of supply’ (RMGL

Section 2(49)). The services which covered under GST, are anything other than

Goods (Article 366 (2A)).

Components of Goods

and Services Tax:

The central government collects

Central Goods and Service Tax (CGST) and Interstate Goods and Service Tax

(IGST) on intra-state and inter-state sale of goods and services while state

government collects State Goods and Service Tax (SGST) on intra-state sale of

goods and services. The IGST collected by the central government is shared

based on the destination of the goods sold. For example, in case a whole-seller

of Punjab sold sugar to whole-seller of Rajasthan; then Goods and Service

Tax on Sugar will be collected by the central government as IGST (suppose

it is 18%, then 18% will be charged as IGST by central government). In the same

case, if the whole-seller of Punjab sold sugar to another whole-seller or

retailer of Punjab then CGST and SGST will be charged equally (suppose it is

18%, then 9% CGST and 9% SGST will be charged by central and state government).

Goods and Services

Tax avoids tax on tax i.e. cascading effect of taxes:

Before Goods and Services Tax, there

was Value Added Tax in existence on the goods. The value added tax was imposed

on each stage of distribution channel on the value added by the involved party.

However, the rate of Value Added Tax was not so much, it was 10% on most of the

goods and the rate of Goods and Services Tax is more i.e. up to 18% on most of

the goods.

Let’s take an

example:

A farmer sells sugarcane @ 20 per kg

to a sugar mill, the sugar mill manufactures sugar and sells it to the whole

seller @ 30 per kg and the whole seller sells it to the retailer @ 40 per kg

and the retailer after packaging, sells it to the consumer @ 50 per kg.

In previous case of

Value Added Tax:

0 Value Added Tax on Rs. 20 = Rs. 0

means the farmer will charge Rs. 20 to the sugar mill, then sugar mill impose

10% Value Added Tax on 30 = Rs. 3 means it will charge whole-seller Rs. 33 and

the whole seller will impose 10% Value Added Tax on 40 = Rs. 4 means it will

charge retailer Rs. 44 and the retailer will impose 10% Value Added Tax on Rs.

50 = Rs. 5 means it will charge the consumer @Rs. 55 per kg.

|

Channel Stage

|

Input

|

Tax

|

Price

|

|

Farmer (Value Added 20)

|

20

|

0

|

20

|

|

Sugar Mill (Value added

10)

|

30

|

3

|

33

|

|

Whole Seller

(Value Added 7)

|

40

|

4

|

44

|

|

Retailer (Value Added

6)

|

50

|

5

|

55

|

|

Total

|

20+10+7+6

= 43

|

12

|

55

|

In this case of Value Added Tax, the

margin in the hands of farmer, sugar mill, whole-seller, and retailer was Rs.

20, 10, 7, 6 respectively.

In present case of

Goods and Services Tax:

Suppose there is 18% Goods and

Services Tax (GST) on packed sugar. In Goods and Services Tax, the person who

pays the tax on acquiring the input, can claim to settle the same at the time

of paying the tax on output which will be input for the next person, and so on.

Let us understand it in this way: The

farmer will not pay Goods and Services Tax (GST) on sugarcane as it is exempt

and will receive Rs. 20 per kg from the sugar mill. The sugar mill will

manufacture sugar and will sell to the whole seller @ Rs. 30 per kg and will

charge 18% GST on Rs. 30 i.e. Rs. 5.4 and the sugar will cost Rs. 35.4 in the

hands of whole-seller. But as the whole-seller will add only Rs. 7, the input

cost will be 30 + 7 = 37 and he will charge tax on 37 @18% i.e. Rs. 6.6 and

will sell it to the retailer @ 43.6 per kg. and the retailer will add only Rs. 6,

the input cost will be 37 + 6 = 43 and will charge 18% GST on Rs. 43 i.e. Rs.

7.74 and the sugar will cost Rs. 50.7 per kg to the consumer. With same value

addition, the cost of sugar in the hands of consumer is Rs. 50.7 with 18% GST

while it was Rs. 55 in previous case of Value Added Tax.

|

Channel Stage

|

Input

|

Tax

|

Actual Tax to Govt.

|

Price

|

|

Farmer (Value Added 20)

|

20

|

0

|

0

|

20

|

|

Sugar Mill (Value added

10)

|

30

|

5.4

|

5.4

|

35.4

|

|

Whole Seller

(Value Added 7)

|

37

|

6.6

|

1.2

|

43.6

|

|

Retailer (Value Added

6)

|

43

|

7.74

|

1.14

|

50.74

|

|

Total

|

43

|

7.74

|

50.74

|

After the sale is completed, the

Goods and Services Tax paid on input will be settled by claim at the time of

filing GST return. In this case of Goods and Services Tax, the margin in the

hands of farmer, sugar mill, whole-seller, and retailer will be Rs. 20, (35.4 –

5.4 - 20), (43.6 – 6.6 + 5.4 – 35.4), (50.74 – 7.74 + 6.6 –

43.6) i.e. Rs. 20, 10, 7, 6 respectively.

Who bears the Goods

and Services Tax?

Instead of 18% Goods and Service Tax,

the sugar costs Rs. 50.74 in the hands of consumer which was Rs. 55 in case of

Value Added Tax in the hands of consumer. It means the consumer is benefited

due to avoidance of cascading effect of the tax i.e. tax on tax. The ultimate

loss was to Government i.e. collecting tax of Rs. 7.74 instead of Rs. 12. There

was no suffering to farmer, sugar mill, whole-seller, and retailer as their

margins are same as at the time of Value Added Tax. Why Government bears the

loss? The Goods and Service Tax is burdened on consumer. The Government agreed

to bear the loss, because the introduction of Goods and Service Tax reduced the

paper work, deployment of man-power for collection of taxes, and reducing the

framework of many previously imposed taxes.

Why taxes levied on Goods and Services?

The

Central Government collects revenues from Service Tax, Excise Duty, Custom Duty

while the States collect revenues through imposition of Entry Tax, Luxury Tax,

Entertainment Tax, Stamp Duty etc. However, with imposition of Goods and

Services Tax (GST), most of the collections are covered under different range

of GST Taxes. The term ‘service’ is very wide and it covers all type of

activities carried out by individuals and companies for earning consideration

with commitment to deliver a specific service. The term ‘Goods’ cover all types

of movable assets other than money; and taxes on transfer of goods for monetary

gains; covered in taxation.

After

enforcement of Goods and Services Tax (GST) on 1st July 2017; the

nomenclature of VAT, Octroi and Entry Tax, Purchase Tax, Excise Duty, Service

Tax, Custom Duty, Entertainment Tax, Luxury Tax; to ‘Goods and Services Tax

(i.e. Central GST, State GST, and Inter-State GST).

The Contract Act 1972, defines the

term ‘Consideration’ as “When at the desire of the promisor, the promisee or

any other person has done or abstain from doing, or does or abstain from doing

or promises to do or abstain from doing something, such an act or abstinence or

promise is called consideration for the promise”.

What does ‘Supply’ mean in GST?

Under GST, the sale / transfer /

barter / exchange / license / rental / lease; made for a consideration; as

known as supply. However, the supplies which made with or without

consideration; coming under GST are specified in Schedule I and the activities

or transactions which are not treated supplies are specified in Schedule III,

and there is schedule IV which provide details of activities or transactions by

Central Government / State Government / Local Authorities not treated as supply

under GST. The GST Council is empowered to notify the transactions to be

treated as ‘supply of goods or not as a supply of goods’ or ‘supply of services

and not as a supply of goods’ or ‘Neither a supply of goods nor a supply of

services’.

In case of mixed

or composite supplies; supply will be considered which attracts the higher rate

of tax.

Registration for GST:

There are provisions to display the

GSTIN in the name board of the business at the entry of office; and the GSTIN

provided is 15 Digit PAN based number including ‘Excise Registration Number +

Tax Identification Number + Sales Tax Number’. In case of new registrations, it

includes first two characters of State Code, then ten characters of PAN, 13th

Character of Entity Code, 14th is blank and 15th is a

‘check digit’.

In GST, there is no paper based

enrolment and the GST Network itself is sufficient to process and generate

GSTIN. While levying GST, if place of supply is intrastate then CGST and SGST

are levied and in case, the place of supply is interstate, then IGST is levied

by manufacturer, trader, or service provider.

Intrastate Vs. Interstate Supply:

Intrastate supply refers to the

supply where location of supplier and place of supply both are within the same

state. The seller or service provider charges the CGST and SGST from customers

and remit the same into the appropriate account of Central and State

Governments. Interstate supply refers to the supply where location of the

supplier and place of supply are in different states. The seller or service

provider charges the IGST from customers and remit the same into the

appropriate account of the Central Government. Further, the Central Government

would share the same with the State of Destination.

Time on which GST becomes liable to be paid:

The goods and services are supplied

and payment for the same is received. But there may be different time of

supplying and time of receiving payment; in such case, confusion arises on

which time, the GST becomes liable to be paid to the Government.

(i) When dates of invoice and amount received are different:

In case of ‘supply of goods’; the

date of invoice or date of receiving payment whichever is earlier is treated as

‘time of supply’ considered for levying GST. In case of date of receipt, it

will be ‘the date on which payment is entered in the books of accounts’ or ‘the

date on which payment is credited into the bank account’ whichever is earlier.

(ii) For purposes of Reverse Charge:

(a) In case of supply of Goods:

The date

of supply for considering the Reverse Charge will be ‘Date of receipt of Goods’

or ‘Date on which payment is made’ or ‘the date immediately following 30 days

from the date of issue of invoice by the supplier’ whichever is earliest.

However, in case it is not possible to determine the date of receipt or date of

payment or date of invoice; then ‘date of entry’ in the book of accounts will

be treated as date of supply.

(b) In case of supply of services:

The date

of supply for considering the Reverse Charge will be ‘Date on which payment is

made’ and ‘the date immediately following sixty days from the date of issue of

invoice by the supplier’. However, in case it is not possible to determine the

date of payment or date of invoice; then ‘date of entry’ in the book of

accounts will be treated as date of supply.

Value of Transaction on which GST is levied:

The price

actually paid or payable for a supply of goods or/and services is taken as an

amount on which GST is levied. It includes taxes, duties, fees and charges

levied under any other statue; incidental charges such as commission and

packing charges charged by the supplier to the recipient; interest or late fees

or penalty for delayed payment of any consideration for any supply; also an

amount incurred by the recipient but supplier is liable to pay even if not

included in the price.

In case of

tax credit, the GST credit is available to manufacturer, trader or service

provider and can be setoff at the time of filing of GST return. The income tax

credit on GST paid will be available only if the following conditions are

satisfied:

(i) the

claimant has tax invoice or debit note issued by supplier or other taxpaying

document;(ii) the

claimant has received goods or/and services;

(iii) the

claimant is claiming income tax credit which is charged by the supplier and the

amount has also been paid by the supplier to the appropriate account of

Government;(iv) the

claimant has furnished the return under section 34.

It is

worth to note that the income tax credit for any invoice cannot be claimed

after the expiry of one year form the date of issue of the tax invoice relating

to such supply. In case, a person claimed wrong Income Tax Credit and same has

been taken by him, such credit will be recovered from the person later on.

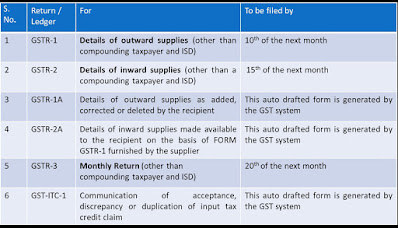

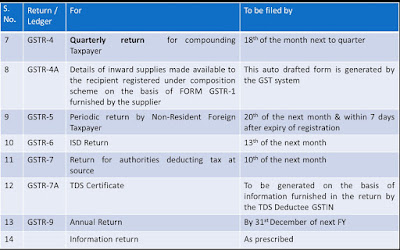

Returns for Goods and Services Tax (GST):

In case,

the GST Returns are not furnished for a continuous period of 6 months, the

registration of GST will be cancelled.

Maintenance of Accounts and Audit thereof in GST:

The

manufacturer, trader and service providers are required to maintain true and

correct account either in physical form or electronic form. The person will

keep the records relating to (i) Account of production or manufacturing of

goods, (ii) Inward and Outward supply of goods or/and services, (iii) Stock of

goods, (iv) Input tax credit availed, (v) Output tax payable and paid, (vi)

Such other particulars as prescribed by the GST Act. The records will be

maintained at ‘Principal Place of Business (PPOB).

Section

53(4) states that every registered taxable person with turnover exceeding the

prescribed limit (i.e. Rs. 40 Lacs), shall get his accounts audited by a

Chartered Accountant or Cost Accountant and shall submit a copy of audited

annual accounts, the reconciliation statement u/s 39 (2) to the proper officer.

Technological Phases of Submitting Goods and Services Tax (GST):

Both the offline and online utilities are available to compute the amount of GST and submit the returns of GST. The downloads on GST portal are direct support of each taxpayer. The e-invoice system can be used by the taxpayers with the turnover more than Rs. 500 Crores.

The suppliers with Nil tax liability in any month can file Nil GSTR-1 through SMS from the registered phone number.

*Copyright © 2018

Dr. Lalit Kumar. All rights reserved.

No comments:

Post a Comment

I will be happy to hear from you. Please give your comments...