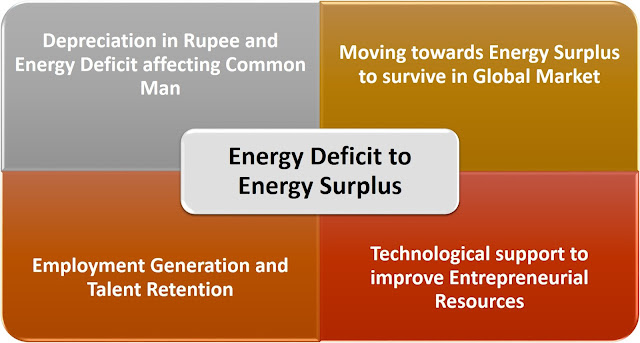

Energy Deficit to Energy Surplus

By Dr. Lalit Kumar Setia

| @drlalitsetia | drlalitsetia@gmail.com

Import of Crude in India:

The biggest concern

which make the Indian Government worried is crude oil imports in quantity

followed by falling value of currency; leading to huge increasing burden on

economy due to energy deficit. In August 2018, the dollar becomes costlier to

Rs. 70.32 and India’s import of crude is quantified to be 227 Million Tonnes

(MT) during 2018-19 which was 220.43 MT during 2017-18. It is worth to mention

here that India meet its oil needs more than 80% from imports and spent 5 to 6

lac crores of rupees (i.e. 80 to 90 billions of Dollars) every year.

Depreciation in Indian Rupee and Energy Deficit affecting Common Man:

The depreciating value of rupee harms Indian economy because the imports are more than the exports. In case, the exports are increased more than imports, then the depreciating rupee will not pinch the economy because the exporters are benefited with the depreciation in currency as they realize more value from their sales in foreign currencies.

The energy deficit which is due to rise in the demand of energy by the Indians, ultimately making India more dependent by increasing the import of oil and coal, known as fossil fuels. With rise in imports the rupee value depreciates due to increase in the Current Account Deficit of India. It also leads to higher cost of crude for the Oil Marketing Companies and the companies pass the increase in cost to the consumers in form of increasing the prices of Petrol and Diesel products.

The Government of India (GoI)

implemented Rural Electrification to connect the un-electrified villages under

its scheme, ‘Deendayal Upadhyaya Gram Jyoti Yojana (DDUGJY)’. Further to reduce

the burden of energy deficit upon common men, the Government started a movement

known as UJALA (Unnat Jyoti by Affordable LEDs for All) and distributed LED

bulbs at subsidized rates. The power reforms through Ujwal DISCOM Assurance

Yojana or UDAY transformed the power sector of States by issuing UDAY bonds to

Distributing Companies (DISCOMs). Various Apps supported the economy to

transform the whole energy sector; such as:

·

Vidyut Pravah (Power Availability & Price) App

to provide real-time information both availability and price of electricity;

· URJA (Urban Jyoti Abhiyaan) App to show the

performance of DISCOM along with data of Integrated Power Development Scheme

(IPDS);

· TARANG (Transmission System Monitoring) App to check

the progress of Transmission System;

· Urja Mitra App to help the citizens accessing the

power outage information of the DISCOMs.

Moving towards Energy Surplus to survive in

Global Market:

India can survive in global market only by

reducing its imports in comparison with exports in value of money. It is

possible to reduce the imports of crude oil by framing policies to reduce the

number of vehicles, adopting the e-solutions to meet the requirements, and

innovate the products can be replaced for meeting the energy demand instead of

increasing the dependency on crude oil.India dreams to be

energy surplus and struggling for it from last five decades. Instead of

initiatives to fulfill the dream, the energy deficit is increasing year after

year. The intellectual persons who can fulfill the dream are setting their life

in abroad to live a healthy and wealthy life. It is time to frame and implement

initiatives to retain the talent and build the spirit of entrepreneurship.

Technology to improve Entrepreneurial Resources:

In order to boost

startup India, there are avenues offered by various international companies

like Whatsapp offered Rs. 1.8 crores to new Indian Startups in Feb 2019 for

those five top winners who win in the competition. It is must to encourage such

competition to boost the creativity of the entrepreneurs and support innovation

in Indian economy.

Discouraging Excess use of Energy Resources:

In India, it is required to discourage excess use of energy resources by increasing the rates or tariff for more consumption. However, in case of electricity consumption, the charges or tariff for the more consumption of electricity is higher after first 200 units. Even the consumers are classified into four categories i.e. Domestic, Commercial, Industrial, and Agricultural.

In August 2019, the Delhi Electricity Regulatory Commission (DERC) reduced fixed charges and increased tariffs in Delhi, to control the excess use of energy. For consumers with electricity load up to 2 Kilo Watt i.e. small shopkeepers, BPL families, and small families; the fixed energy charges are slashed significantly i.e. from Rs. 125 to Rs. 20. Even for the consumers with electricity load from 2 KW to 5 KW which covered mostly all domestic and commercial consumers; the fixed energy charges slashed from Rs. 140 to Rs. 50. For the consumers with electricity load from 5 KW to 15 KW which covered domestic consumers and small scale industries, cottage industries etc; the fixed charges slashed from Rs. 175 to Rs. 100. It is to encourage the consumers to not increase their electricity load. Even the consumers with excess load, can decrease their load and get it reexamined to get the benefit of slashed fixed charges.

In order to discourage the excess use of electricity, for domestic consumers, the tariff for the units above 1200 units made Rs. 8 per unit earlier it was Rs. 7.75 per unit. While in case of industrial consumers, the tariff revised from Rs. 7.25 per unit to Rs. 7.75 per unit*.

*Copyright © 2018 Dr. Lalit Kumar.

**This information was retrieved from website of Delhi Electricity Regulatory Commission on 3rd August 2019.

**This information was retrieved from website of Delhi Electricity Regulatory Commission on 3rd August 2019.