Government

and Rising Fuel Prices

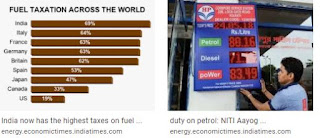

No doubt, the economic progress depends upon the money spent by Government and in order to meet the requirements of budget, one of the tool is duties on petrol, diesel, and gas products. In India, the fuel prices increased from time to time. The data states that with the increase in fuel prices, the taxation part in the fuel prices of India, has become maximum in entire world. The Economic Times published the data in newspaper from time to time.

Impact of Rising Fuel Prices

The imposition of

excise duty on petrol, diesel, and gas directly affect the life of common

people. Whenever the crude oil prices are increased in the international

market, the oil marketing companies increase the prices of petrol, diesel and

natural gas. With rise in the prices in petroleum products, the prices of all

things rise and the life of common people affected significantly. The news

reporters, economists, and other experts sometimes look for the solutions to

this problem by reducing the excise duty upon the products. Can Government do

anything to safeguard the people from the heat of rising fuel prices?

Protection

of Environment:

More the use of petroleum prices,

more the pollution will be affecting the life of common people. In order to

protect the environment and set-off the negative affects of climate change,

global warming etc; the government rises the duties and taxes upon petroleum

products. The government can safeguard people from rising fuel prices by

providing the alternate means of transportation and promoting the eco-friendly

vehicles like e-riksha, e-car, e-bus and vehicles based on solar energy.

Controlling

the Fiscal Deficit:

In case, the petroleum products are

being consumed at higher rate of growth; the fiscal deficit will be rising and

affecting the value of rupee. More the consumption of petroleum products, more

the crude will be imported and the rupee will be depreciated. The Government

should reduce the import of crude and it is possible only by encouraging people

to cut the consumption of products based on crude. The Government should run

campaign to reduce the consumption of petroleum products and promote the power

generation through renewable energy sources including bio-mass.

GST on Petroleum Products:

The Chief Economic Advisor K V Subramanian suggested to bring petroleum products under the ambit of the Goods and Services Tax (GST) on 27th February 2021; in order to reduce the food inflation. However, the decision lies with the GST council.